Using the NCL Government Capital Vendor Portal

Below you will find useful information regarding our vendor portal we recently launched. As an NCL partner, you have 24/7 access to your very own customizable vendor portal and can generate finance proposals to your customers within minutes. Contact your NCL representative today if you would like to be added as a NCL partner.

Download the user guide below:

Guided Tour | NCL Vendor Portal

This short video walks you through the process of generating a proposal from within your portal. We also quickly demonstrate the other features of the vendor portal such as the training & marketing materials.

Expand the video to watch in full screen!

Contact your NCL representative with further questions

This shortened click through video demonstrates how to generate a customer facing financing proposal for your customer.

Expand the video to watch in full screen!

Contact your NCL representative with further questions

Guided Tour | User Account Request

This short video walks you through the process of requesting access to an existing NCL Government Capital vendor partnership. To be used for management, marketing and your sales team.

Expand the video to watch in full screen!

Contact your NCL representative with further questions

NCL FAQs

We receive numerous questions regarding the portal and simply tax-exempt municipal leasing in general. Here, we answer the top 5 questions we receive from those seeking funding solutions. Download the flyer!

Every Agency is required to budget expenditures for the next fiscal year. In the event the Agency does not include the lease payments in the budget, the Agency can elect to return the equipment and cancel the lease.

NCL can defer a payment up to 12 months, allowing government agencies to make their first payment in their next fiscal year.

NCL designs leases based on the customer’s needs. Depending on the asset we have gone out as far 15 years.

1. Customer signs proposal and returns to NCL

2. NCL request credit package (credit application and financial statements)

3. NCL completes underwriting

4. NCL prepares documents and forwards to customer

5. NCL works directly with customer to finalize document signing

6. Upon receipt of originals, NCL will fund the transaction.

A Tax-Exempt Municipal Lease is very much like a loan with the exception of the non-appropriation clause. The Agency takes ownership from day one, and NCL is a secured party. There is no buyout or need to renew/return the equipment. The Agency owns the equipment free and clear upon NCL’s receipt of their final payment.

NCL Documents

NCL Portal

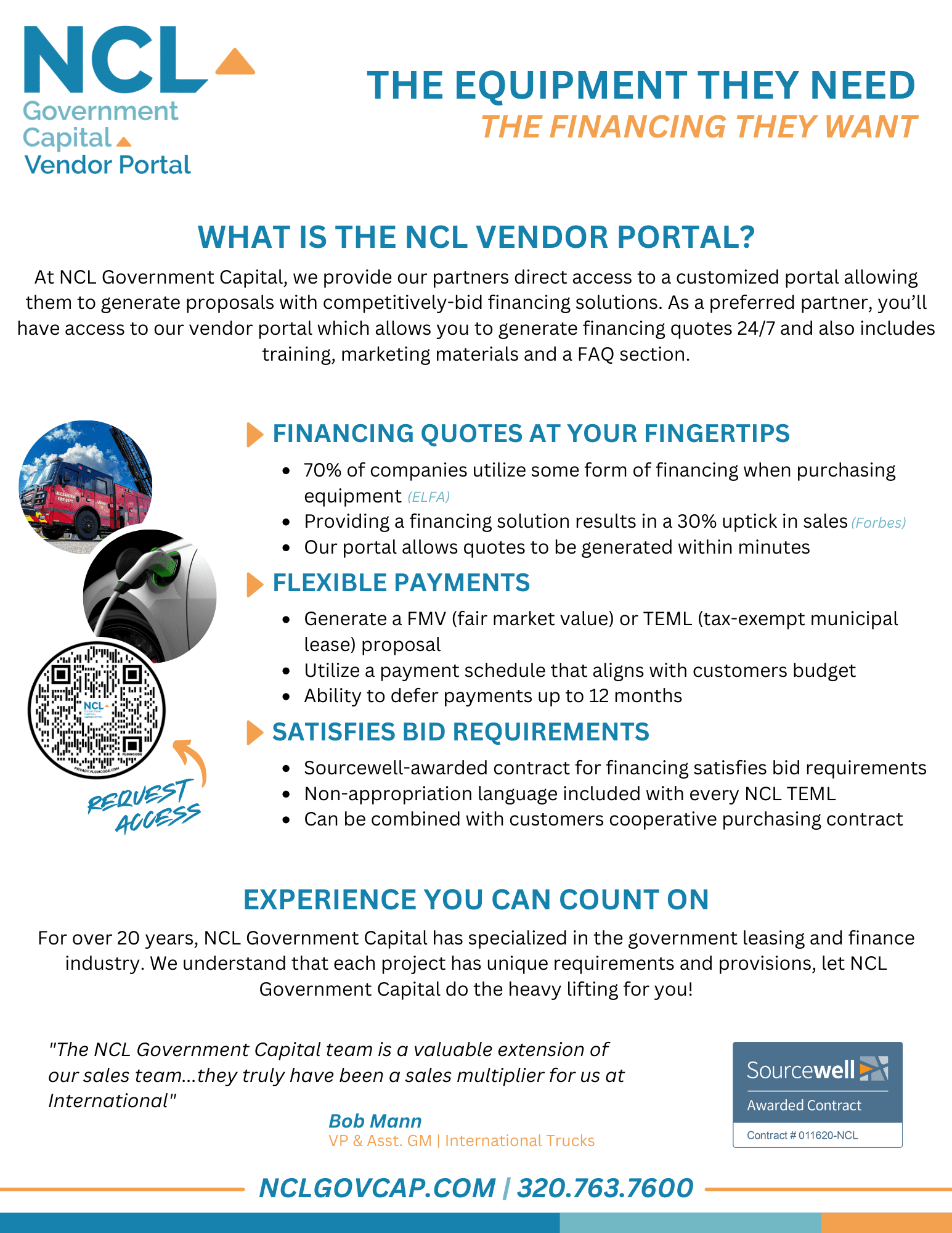

What is the NCL Government Capital Portal and how does our financing help your business?

Timeline

Do you know when to introduce a finance option to your customers?

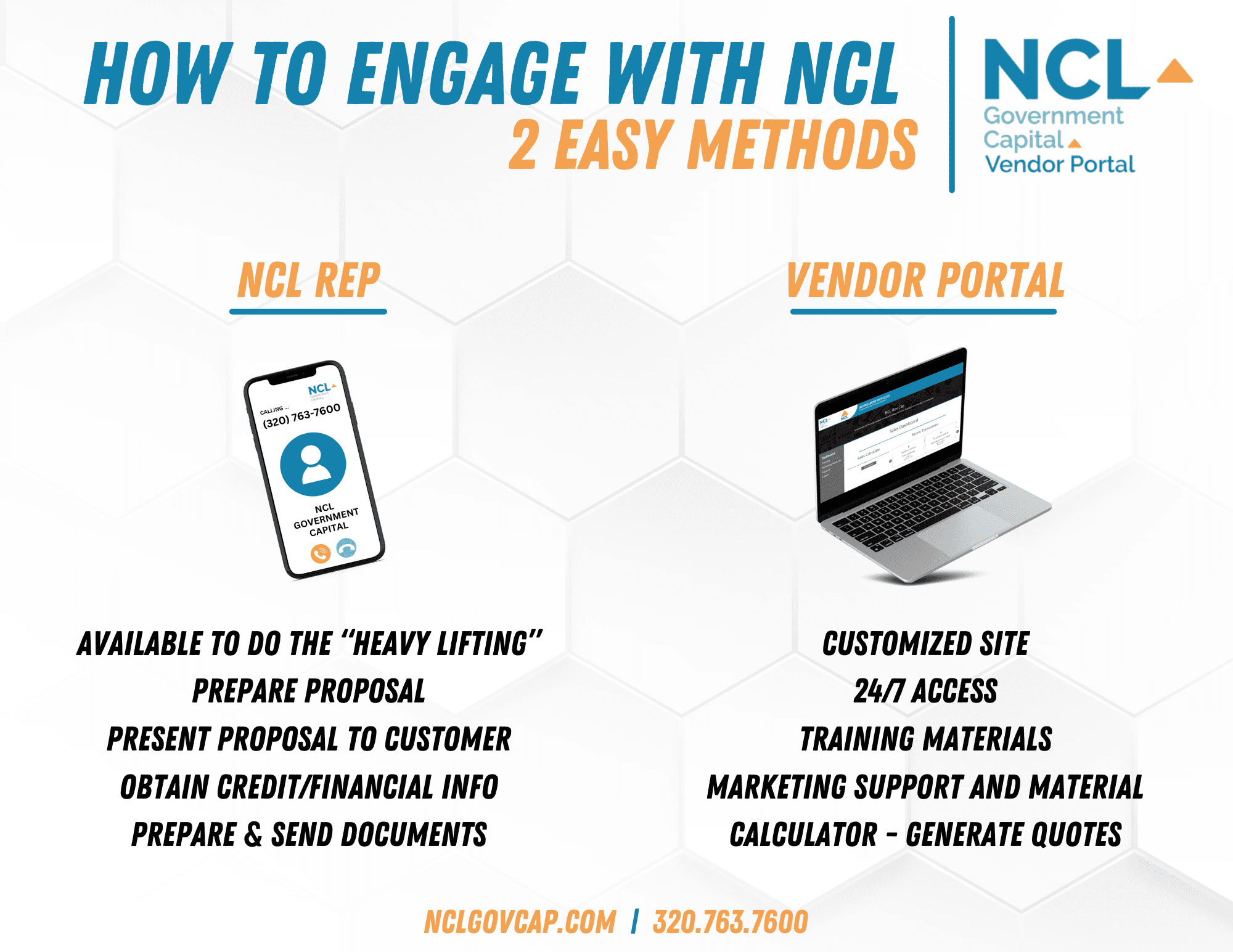

Engage

Your NCL representative is always a phone call or email away, but when you need 24/7 access, find everything you need in your vendor portal!

TEML

A tax-exempt municipal lease is the least expensive form of financing available to government agencies. Learn more TEML facts!

Sign Up

An abbreviated guide to creating your vendor portal with NCL Government Capital. Contact your NCL rep to learn more.